Standing Firm Amidst Backlash

Finance Minister Chrystia Freeland is standing firm amidst widespread backlash against the government’s proposed increase in capital gains tax. In this week’s budget unveiling, she framed the adjustment as a call for well-off Canadians to contribute more to support the government’s spending commitments.

The budget, unveiled on Tuesday, introduces changes that would raise the taxable portion of capital gains to two-thirds from one-half for corporations and trusts. Individuals would also feel the impact, but only on capital gains exceeding $250,000. These modifications are slated to take effect on June 25.

Ms. Freeland remarked, “We’re asking those who are prospering in our country to chip in a bit more so we can make the necessary investments for Canadians.” She conveyed this message during a visit to the University of Toronto, part of the government’s effort to promote its budget.

The minority Liberal government anticipates that these additional taxes will generate $19.4 billion in revenue over five years, essential to fund spending commitments in various sectors like housing, health care, defense, and scientific research. The Liberals seek to regain support and appeal to young voters amidst ongoing polls showing them trailing behind the Conservatives.

However, the proposal has sparked outrage among many technology entrepreneurs and investors. It has overshadowed other innovation-friendly measures in the budget, such as the $2.4 billion funding for artificial intelligence. Critics argue that the capital gains tax hike will reduce profits for those selling businesses or converting stock options, potentially discouraging startups in Canada at a time when productivity is declining.

Entrepreneurs and Investors React

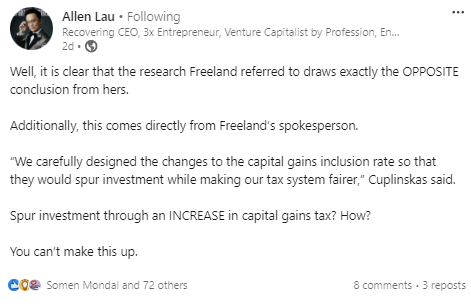

As news of Canada’s proposed capital gains tax hike reverberates across the nation, the tech industry stands at a crossroads, grappling with the potential repercussions on innovation and entrepreneurship. At the forefront of this debate are the country’s leading entrepreneurs and investors, whose voices echo with concern and frustration.

With the promise of prosperity and growth hanging in the balance, these influential figures are not merely spectators but active participants in shaping the future of Canada’s economic landscape.

Their reactions to the proposed tax adjustments paint a vivid picture of the challenges and opportunities that lie ahead, igniting a fiery discourse that resonates far beyond the boardrooms and startup hubs.

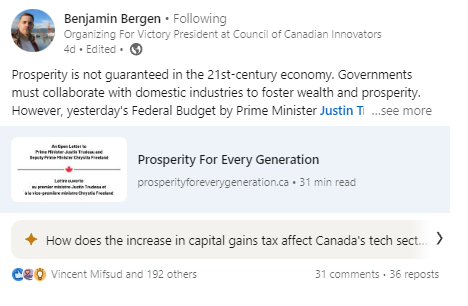

Take Action: Sign the Letter

The proposed changes threaten to greatly hinder homegrown businesses’ access to crucial capital, imposing a tax on the success that drives Canada’s essential social programs and infrastructure.

More than 1500 CEOs and leaders have signed a letter urging the government to reconsider its decision and work with the industry to chart a new course toward prosperity for all generations.

If you echo our concerns and want to make a difference, please sign the letter: https://www.prosperityforeverygeneration.ca/

Sign the letter: https://www.prosperityforeverygeneration.ca/